[ad_1]

Have you ever heard of 401(ok) enterprise financing, often known as Rollovers for Enterprise Startups (ROBS)? Whereas 401(ok) is essentially the most generally used, ROBS allows you to use numerous retirement funds to finance your enterprise. However is ROBS protected?

Like another enterprise mortgage, utilizing ROBS is investing in your enterprise. In contrast to a enterprise mortgage, you don’t have to fret about over-hanging debt. That’s the factor: ROBS isn’t a mortgage. And that’s why it’s change into an more and more well-liked financing methodology amongst entrepreneurs trying to begin their enterprise debt-free and cash-rich.

Preserve studying for an in-depth breakdown of what ROBS is and the way it works — and a evaluate of its key benefits and attainable disadvantages.

Individuals who make investments normally select from a number of asset lessons: shares, bonds, actual property, and extra. Every has a threat/reward profile. For instance, the inventory market and mutual funds can recognize nicely but additionally lose worth in market fluctuations. However an alternate type of financing, Rollovers for Enterprise Startups (ROBS) or 401(ok) financing, can also be a sort of funding. Should you run a small enterprise or are an aspiring entrepreneur, ROBS could be an funding in your enterprise’s fairness, a wage from the enterprise, and your future.

ROBS is an more and more well-liked type of small enterprise financing by which entrepreneurs use their very own retirement funds, corresponding to 401(ok)s, to fund their firm, slightly than financing strategies corresponding to a financial institution mortgage or making an attempt to boost fairness from exterior traders. The truth is, in our Small Enterprise Developments 2024, over half of respondents used ROBS as their financing selection.

Let’s briefly talk about how a ROBS program works and its benefits. We’ll additionally have a look at its attainable disadvantages that can assist you make an knowledgeable resolution about an funding in ROBS.

How ROBS Works

Using ROBS permits small enterprise homeowners to spend money on their companies by utilizing their very own retirement plans. Whereas the usage of 401(ok)s is frequent sufficient that “401(ok) financing” is an often-used time period for ROBS, a variety of retirement plans utilizing employer contributions and worker contributions are certified, together with conventional Particular person Retirement Accounts (IRAs), 457(b)s, 403(b)s, Thrift Financial savings Plans (TSPs), Financial savings Incentive Match Plan for Workers (SIMPLE) IRA Plans, Simplified Worker Pension Plan (SEP) IRAs, Keogh Plans and different plans, corresponding to pensions.

Should you withdraw cash from tax-advantaged retirement plans, you normally should pay tax for those who’re not but 59½ years outdated — and you might be topic to fines for early withdrawal. ROBS protects you from each taxes and fines.

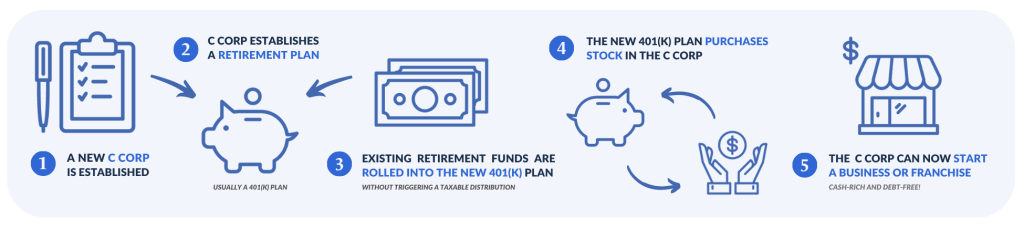

So, how does ROBS work? In ROBS, you arrange a C Company (C Corp) and set up a brand new retirement plan for the C Corp, open to all staff. As soon as that’s established, your retirement funds are rolled into the brand new C Corp’s retirement plan. The cash is used to buy inventory in a brand new C Corp. As soon as that’s carried out, the cash can be utilized for nearly any enterprise goal.

Benefits of ROBS

Successfully, using ROBS is investing your chosen retirement accounts into your enterprise. ROBS can confer many benefits on small enterprise homeowners and aspiring entrepreneurs vis-à-vis different funding choices.

Debt and Penalty-Free Financing

Many individuals flip to enterprise loans as their first funding selection, for instance. However enterprise loans can have vital drawbacks. The primary is month-to-month debt funds. Debt funds can sap the money movement that companies want to remain afloat. Bear in mind: ROBS allows you to begin your enterprise debt-free and cash-rich. Why? Bear in mind: ROBS isn’t a mortgage. Which means you aren’t caught with paying costly month-to-month debt funds.

What’s extra, ROBS permits you to withdraw out of your retirement funds early with out dealing with costly taxes or penalty charges, providing you with full management over your funds.

No Collateral or Credit score Required

As well as, enterprise mortgage lenders typically have necessities which might be onerous for small companies. They typically need collateral, corresponding to private property (like a home), as safety in opposition to threat. Should you default on the mortgage, your collateral goes to the financial institution. They typically additionally need giant down funds of as much as 30 % of the mortgage. That’s a big money outlay, particularly for a startup.

With ROBS, you don’t have any collateral requirement (which suggests no threat to your collateral), and no down cost requirement. ROBS may even be used at the side of a mortgage, and for all or a part of a down cost. Study extra in Utilizing Your 401(ok) as an SBA Mortgage Down Cost — Penalty-Free.

In contrast to conventional enterprise loans that closely depend on creditworthiness, ROBS additionally bypasses this requirement completely. This facet of ROBS is invaluable for people who might face challenges acquiring approval for typical financing as a consequence of their credit score historical past. By leveraging funds from eligible retirement accounts, corresponding to 401(ok)s — with out incurring early withdrawal penalties or taxes — aspiring enterprise homeowners can sidestep the credit score barrier completely.

Full Freedom

One other well-liked financing selection for small companies is elevating fairness from exterior traders. This may appear very engaging. Angel traders and enterprise capitalists typically focus on companies of a sure measurement and business. Household and buddies can probably be a supply of outdoor funding. However elevating fairness isn’t with out threat.

The chief threat is that fairness traders in your enterprise have a stake in it. Which means they’ve the correct to weigh in on the choices and course — that means your enterprise can change into much less topic to your management. The truth is, enterprise homeowners have been identified to lose management completely to exterior traders.

Outdoors fairness traders may also dilute your personal holdings in a enterprise. If your enterprise positive aspects worth over time, you’ll not personal 100% of that worth as a result of exterior fairness traders will personal some proportion of it.

With ROBS, you might be your personal angel investor. You keep full management over your enterprise — the choices and its course. Outdoors traders can’t oust you.

Quick Financing

Each debt-heavy and fairness financing strategies may also sap the time of small enterprise homeowners. Loans require time-consuming purposes, and fairness financing requires compiling shareholder materials and pitching to traders. ROBS, then again, is comparatively streamlined and could be accomplished in roughly one month — a lot much less time than another financing methodology.

ROBS may also be notably advantageous for those who’re coping with particular conditions. First, if you wish to begin a enterprise whilst you’re nonetheless employed, it may be difficult to get a mortgage or fairness traders. ROBS places funding in your management. (You may even use ROBS whereas maintaining your job.) Second, for those who’ve had previous challenges with credit score, chances are you’ll not have the credit score rating a mortgage requires. ROBS removes all want for a credit score rating because the cash is your personal.

Study the ins-and-outs of 401(ok) Enterprise Financing in What’s ROBS? How 401(ok) Enterprise Financing Works.

Disadvantages of ROBS

Doubtlessly Shedding Your Nest Egg

ROBS has, candidly, a number of potential disadvantages as nicely. The primary is the danger of shedding your retirement nest egg and never having a cushty retirement. Don’t overlook: All small companies carry some threat of failure, whether or not due to a scarcity of earnings, a macroeconomic downturn, or another cause. In case your ROBS-financed enterprise fails, you’ll lose the retirement funds you used, in addition to the enterprise itself and any earnings you acquired from it.

This generally is a daunting prospect, however it’s useful to do not forget that the danger of failure exists for different investments you could be contemplating. You can even lose cash invested within the inventory market. In case your investments are in bonds or money, the rates of interest you earn on them might not outpace inflation (they at present don’t), which suggests the cash is successfully diminishing in worth over time.

All potential financing sources additionally pose dangers if the enterprise isn’t profitable. Should you get hold of a small enterprise mortgage and your enterprise closes, you’ll nonetheless should make the debt funds on the mortgage whereas shedding the enterprise itself and any earnings you acquired from it. Moreover, there’s the potential to lose the precious collateral you’ve pledged for the mortgage. Should you get exterior fairness traders and the enterprise seems to be prone to fail, they might take it over completely or promote their shares.

Bear in mind: Whereas utilizing ROBS, you possibly can proceed to develop your nest egg as your enterprise grows. You may select how a lot funds you wish to borrow out of your retirement and the way a lot to place again in over time.

Lack of Diversification

One of many funding dangers ROBS carries is a lack of diversification, as your enterprise, your wage, and your retirement might all be centered on the identical enterprise. One technique to guard in opposition to that’s solely utilizing a part of your present retirement funds for ROBS. One other is to speculate your new retirement funds in investments aside from the brand new C Corp inventory.

Extra Sophisticated Administration

Along with threat, ROBS additionally comes with extra advanced administrative work. You’ll need to be sure to comply with all necessities particular to ROBS, corresponding to being an worker and working a enterprise authorized on the Federal stage. You’ll want to supply documentation in regards to the enterprise and the brand new retirement plan for each the Inside Income Service (IRS) and the Division of Labor. Your likelihood of an IRS audit received’t essentially be better, but when one happens, it might be extra advanced for those who use ROBS than for those who don’t. You’ll must administer the brand new retirement plan.

Typically, your ROBS suppliers assist with the executive burden and supply entry to authorized and accounting steerage for a price. Your ROBS supplier will allow you to arrange and administer ROBS — and supply recommendation about rules and necessities.

Get a complete have a look at 401(ok) enterprise financing in Our Full Information to Rollovers for Enterprise Financing (ROBS).

So, is ROBS an excellent funding for you? Now that you already know its potential benefits and downsides, you may make an knowledgeable resolution on whether or not ROBS is the best for you or not. For a lot of, ROBS has been their ticket to enterprise success and monetary freedom.

Able to be taught extra about ROBS? Remember to try our Prime 10 Sources and Information to Getting Began with ROBS.

Guidant Monetary: A Accomplice for Your Enterprise

Should you’re on the lookout for a dependable ROBS supplier — and enterprise companion — look no additional than Guidant Monetary. Guidant is the No. 1 ROBS supplier within the U.S. Since 2003, we’ve helped fund and help over 30,000 small companies nationwide. Our aim is easy: We’re right here to help your enterprise and its path with enterprise financing options and providers designed that can assist you succeed. Whether or not you have got a small enterprise concept to ascertain, a franchise to buy, or a enterprise to develop, we’d like to be your trusted companion.

At Guidant, we perceive your objectives and monetary scenario is exclusive. Whether or not you’re trying to finance your enterprise with ROBS, SBA loans, or a mix of strategies, our group of consultants can assist tailor the very best technique to fulfill your wants and objectives — taking the stress out of enterprise financing.

Name us right this moment at 425-289-3200 for a free, no-pressure enterprise session to get began — or pre-qualify in minutes for enterprise financing now!

“When Falling Sky Brewing introduced itself as a terrific alternative for me, I wanted the capital. Conventional lenders weren’t going to do it. I took an opportunity on myself that I might develop my enterprise and my 401(ok)… And I assumed, ‘You recognize what? I might do that with out overhanging debt.‘”

— Stephen Such, Falling Sky Brewing

Learn the tales of REAL small enterprise homeowners who work with Guidant.

[ad_2]