[ad_1]

Every year, Guidant conducts a complete research to grasp American small enterprise homeowners’ experiences, challenges, and future plans. On this submit, we’ll delve into the highest highlights from Guidant’s 2023 Small Enterprise Tendencies research — specializing in the phase devoted to Entrepreneurs of Coloration. Our Entrepreneurs of Coloration research reveals insights into the aspirations, challenges, and rising developments of minority-owned small companies.

Get the total scoop on small enterprise developments, challenges, and extra in Guidant’s full 2023 Small Enterprise Tendencies research.

The 2021 Annual Enterprise Survey (ABS) performed by the Census Bureau confirmed a big improve in each the variety of Hispanic-owned companies total and minority-owned companies in numerous sectors in comparison with a decade in the past. Equally, the 2020 Census revealed that the inhabitants of just about all racial and ethnic teams in america had skilled development since 2010 — and the expansion hasn’t stopped.

In response to the Census Bureau, round 1.2 million small companies within the U.S. are owned by minorities. Minority-owned companies account for roughly 20 p.c of small companies — and make use of roughly 9.9 million staff with an annual payroll totaling $357.4 billion.

In comparison with pre-pandemic ranges, Black enterprise possession rose by 38 p.c this 12 months with a reported 23 p.c uptick in annual income development, which is twice as quick for the typical American enterprise. Black-owned small companies additionally recruited workers at double the speed of all companies throughout the US, displaying promising development and confidence in the way forward for small companies owned by folks of coloration.

Within the 2023 Small Enterprise Tendencies Research, we proceed to see the resilient spirit of entrepreneurship, the shifting range of small enterprise homeowners, and the difficult dynamics influenced by a altering financial system. Let’s have a look at an summary of the highest developments and findings highlighted within the Entrepreneurs of Coloration research, beginning with exploring the demographics and motivations amongst minority enterprise homeowners surveyed.

Don’t overlook to discover our full, in-depth Entrepreneurs of Coloration report for extra knowledge, graphics, and insights.

Demographics and Motivations

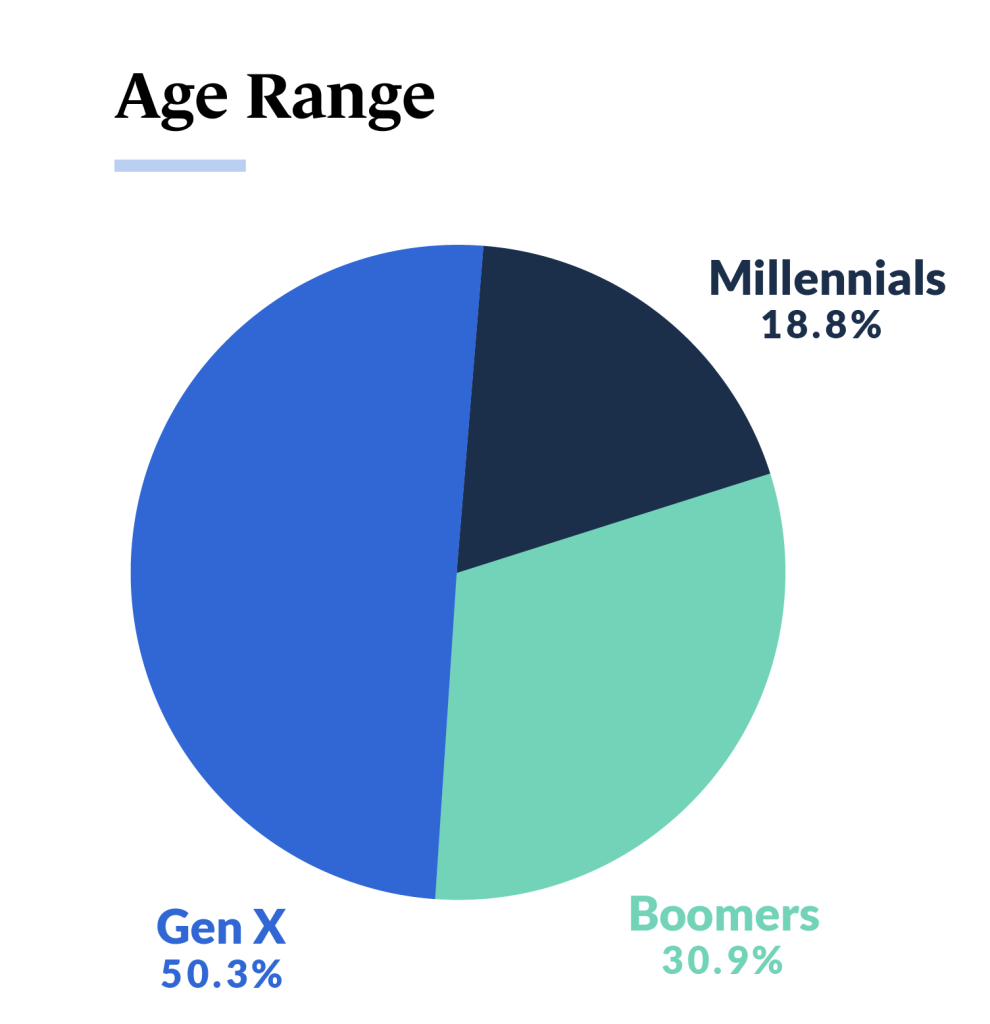

- The generational hole considerably impacts small enterprise homeowners, together with entrepreneurs of coloration. Over half of the small enterprise homeowners of coloration surveyed are Gen X (50.34%), with greater than 30 p.c being Boomers (30.97%).

- Lower than 19 p.c of the entrepreneurs of coloration surveyed are Millennials (18.79%). Nonetheless, small enterprise possession is altering — with youthful generations, millennials changing into extra prevalent. This shift is predicted to proceed as extra Millennials attain the typical age of enterprise possession (round 35 years outdated).

- The variety of millennial enterprise homeowners of coloration has elevated by 32 p.c from final 12 months, whereas the variety of these within the Boomer era has decreased by 15 p.c.

- The highest motivators for entrepreneurs of coloration had been the need to be their very own boss (30%), dissatisfaction with company America (20%), and pursuit of ardour (13%) — the strongest three motivators had been constantly cited among the many enterprise homeowners surveyed this 12 months. Elements similar to job loss (9%) and seizing a possibility (11%) had been widespread causes for beginning their companies. Solely eight delayed retirement, a barely decrease share in comparison with different teams.

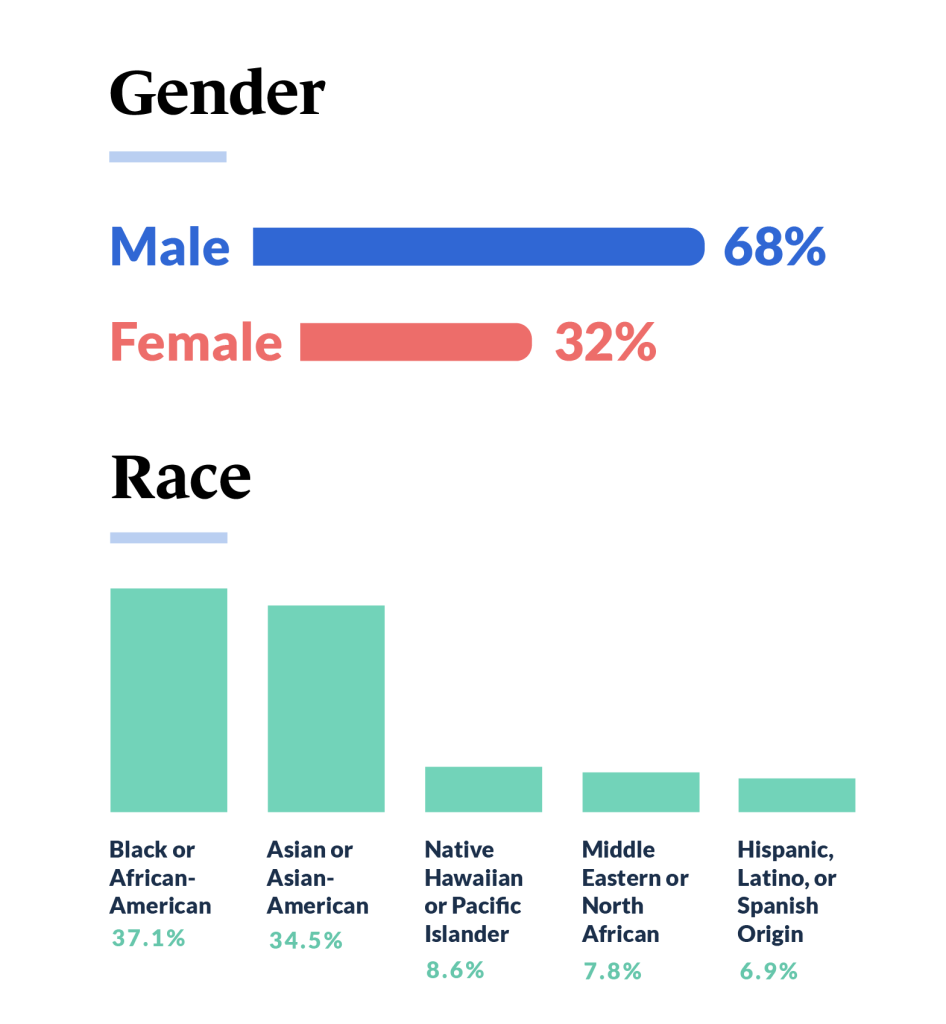

- Male entrepreneurs of coloration usually tend to personal and function companies than their feminine counterparts, with 68 p.c of surveyed enterprise homeowners of coloration figuring out as male and 32 p.c as feminine.

- Regardless of this, girls of coloration are beginning and rising companies at a quicker fee than another demographic within the U.S. Black women-owned companies grew 67 p.c from 2007 to 2012 and 50 p.c from 2014 to 2019 — marking the very best development fee of any feminine demographic. The research reveals a development of a 28 p.c improve in women-owned companies amongst entrepreneurs of coloration in comparison with earlier years.

- The vast majority of enterprise homeowners of coloration surveyed recognized as “Black or African-American” (37%) and “Asian or Asian-American” (34%). “Native Hawaiian or Pacific Islander” was the third-largest group at 8.62%, whereas about seven p.c recognized as “Hispanic, Latino, or Spanish-Origin” (6.90%) and “Center Japanese or North African” (7.76%).

- Most surveyed entrepreneurs of coloration didn’t really feel represented by any political get together (40%). The second and third largest teams affiliated with the Democratic (34%) and Republican events (20%), respectively. Solely six p.c of entrepreneurs of coloration reported being Libertarian, a slight improve from the earlier 12 months. Nonetheless, there have been no vital modifications in political affiliations amongst entrepreneurs of coloration in comparison with final 12 months.

- In comparison with the principle research, entrepreneurs of coloration had been 26 p.c extra prone to really feel unrepresented by any political get together and 75 p.c extra prone to affiliate as Democratic. Whereas most small enterprise homeowners within the main research affiliate as Republican, most minority enterprise homeowners both don’t really feel represented by any political get together or affiliate as Democratic. Entrepreneurs of coloration had been 52 p.c much less prone to affiliate with the Republican get together.

- The research discovered a robust correlation between schooling ranges and enterprise possession, significantly amongst entrepreneurs of coloration. Amongst surveyed entrepreneurs of coloration, 82 p.c held a level: a grasp’s diploma (38%), a bachelor’s diploma (34%), and an affiliate diploma (10%). A smaller share held a doctorate diploma (9%). Solely 9 p.c of surveyed enterprise homeowners of coloration had solely a highschool diploma. Entrepreneurs of coloration had been two p.c extra prone to maintain a level than the principle research.

High Industries and Enterprise Sorts

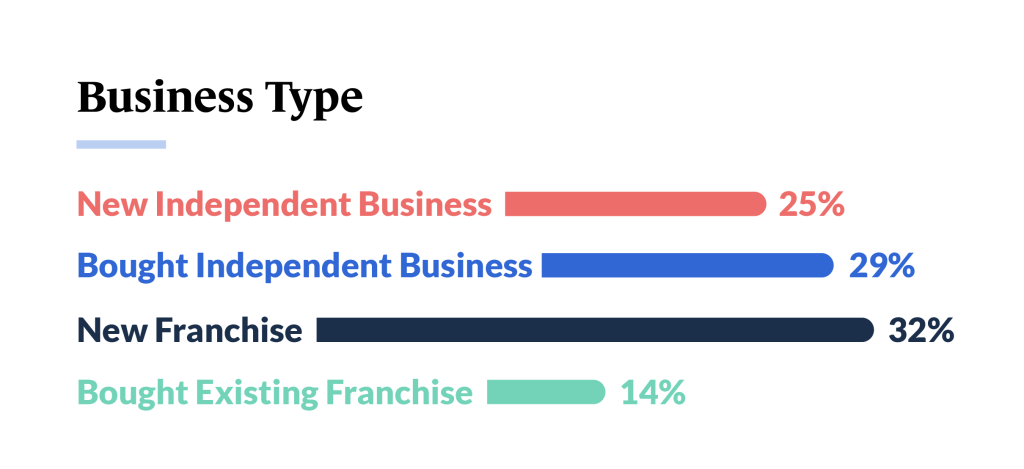

- A majority of entrepreneurs of coloration reported beginning or buying a brand new franchise location this 12 months, accounting for 32 p.c of surveyed respondents. This development is according to the principle research, the place 35 p.c of all small enterprise homeowners began a brand new franchise in 2023. The smallest share of respondents (14%) reported buying an current franchise location.

- Twenty-nine p.c of entrepreneurs of coloration reported buying an current impartial enterprise, barely decrease than the 33 p.c in the principle research who reported doing so. Entrepreneurs of coloration had been additionally extra prone to begin a brand new impartial enterprise from scratch. 1 / 4 of respondents (25%) reported beginning a brand new impartial enterprise.

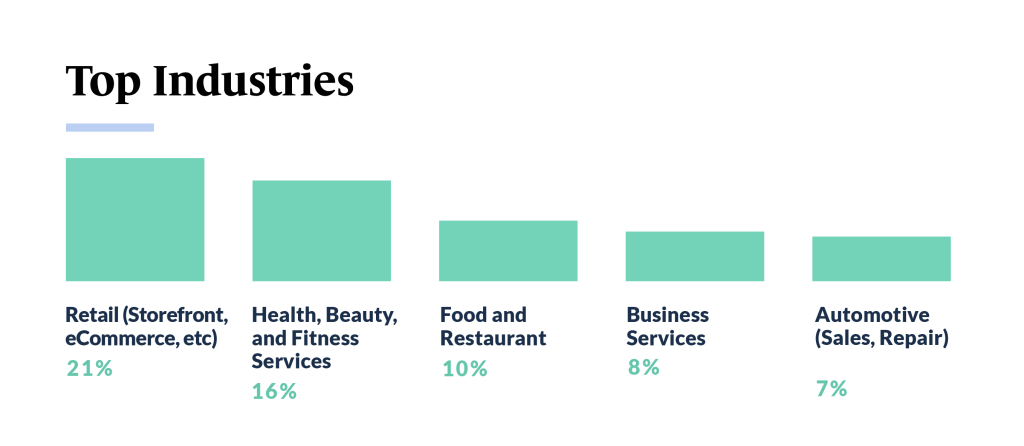

- The retail business is the preferred amongst small companies, with 21 p.c of respondents proudly owning companies on this sector. Entrepreneurs of coloration had been 17 p.c extra prone to personal a retail enterprise than the principle research.

- The Well being, Magnificence, and Health providers business ranked second amongst entrepreneurs of coloration, comprising 16 p.c of their companies. The Meals and Restaurant business can be nonetheless common amongst enterprise homeowners of coloration, with 10 p.c of them operating companies on this sector.

- Enterprise providers, automotive providers, and schooling every make up roughly eight p.c, tying for fourth place among the many high industries for entrepreneurs of coloration. Childcare and residential providers accounted for six p.c of small companies owned by entrepreneurs of coloration. Regardless of a rising demand within the building and contracting business, solely 5 p.c of companies owned by entrepreneurs of coloration are on this sector.

High Challenges

- Small enterprise homeowners of coloration have confronted challenges this 12 months, together with financial uncertainty, political unrest, recruitment and retention, inflation, and lack of capital. The three largest challenges reported had been recruitment and retention (24%), inflation and rising costs (21%), and lack of capital (16%).

- The highest three challenges had been the identical throughout all segments. Nonetheless, enterprise homeowners of coloration reported an eight p.c increased issue with money circulation than different enterprise homeowners surveyed. This disparity in money circulation issue has been constant in earlier years’ knowledge, peaking at a ten p.c distinction.

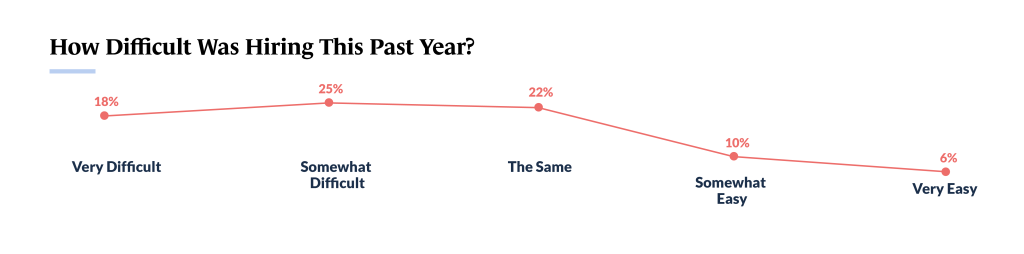

- The development of recruitment and retention being a main problem continues from the earlier 12 months, although fewer reported this issue within the present 12 months. Nonetheless, recruitment continued to be a big problem for enterprise homeowners of coloration this 12 months — with over 40 p.c of surveyed respondents describing the hiring course of as both considerably or very troublesome. In reality, 25 p.c reported recruitment as “considerably troublesome in comparison with different years” and 18 p.c as “very troublesome in comparison with different years.”

- Entrepreneurs of coloration plan to ease hiring difficulties this 12 months by providing extra compensation (27%), bettering retention efforts (21%), and increasing advantages (9%) or recruitment promoting (10%).

- Whereas it’s difficult to search out certified candidates throughout the board, essentially the most troublesome position to fill this 12 months had been gross sales positions (17%), administration positions (16%), healthcare positions (15%), and meals service positions (15%) amongst enterprise homeowners of coloration.

- A majority of respondents reported a low variety of candidates or lack of curiosity as a big recruitment barrier (22%). Coming in at an in depth second, 20 p.c of enterprise homeowners reported competitors from different employers as a essential problem. Many enterprise homeowners of coloration additionally stated job candidates lack work expertise (18%), technical expertise (11%), and comfortable expertise (11%).

Going through Financial Uncertainty and Confidence within the Future

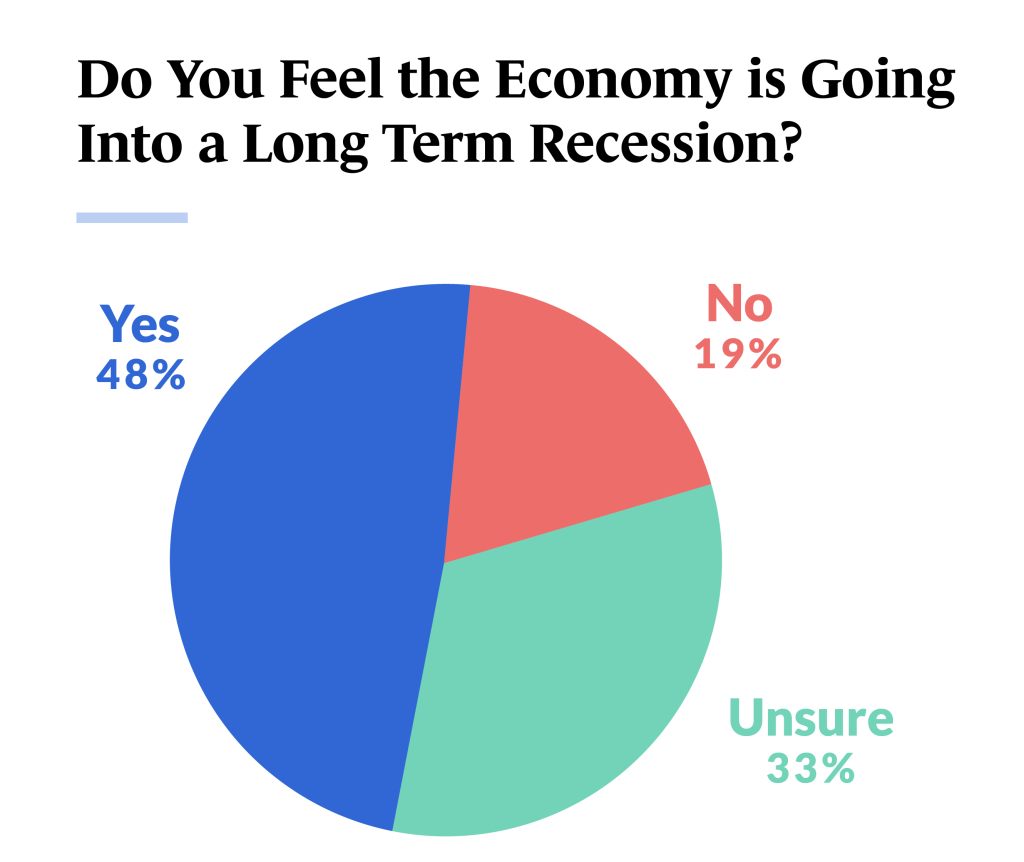

- Practically half of surveyed small enterprise homeowners of coloration imagine the U.S. is heading right into a long-term recession (48%), whereas 33 p.c are not sure. Fewer respondents are assured that the U.S. isn’t heading right into a long-term recession (19%).

- Many enterprise homeowners of coloration lack confidence in right this moment’s altering financial local weather, with 29 p.c feeling “considerably unconfident” and 11 p.c feeling “very unconfident.”

- Nonetheless, 38 p.c of enterprise homeowners are “considerably assured” (30%) to “very assured” (8%), and 22 p.c really feel impartial.

- Regardless of financial issues, nearly all of entrepreneurs of coloration are optimistic in regards to the future, with 74 p.c feeling assured that their companies will survive in right this moment’s financial system. In reality, small enterprise homeowners of coloration had been extra assured in regards to the financial system than all different enterprise homeowners surveyed this 12 months — with a 16 p.c increased confidence stage.

Enterprise Plans and Happiness Ranges

- Many minority-owned companies plan to make strategic investments of their companies this 12 months. The primary focus is addressing recruiting difficulties, with 27 p.c planning to extend their employees.

- The second hottest plan for 2023 is investing in advertising and marketing — 31 p.c anticipate investing in conventional and digital advertising and marketing.

- Enterprise enlargement and reworking are the third hottest plans (19% every).

- Within the face of recent financial challenges and uncertainty, a majority of small companies owned by folks of coloration had been worthwhile this 12 months (54%). This can be a promising signal, significantly given that almost all respondents are new enterprise homeowners who sometimes take two to a few years to achieve profitability.

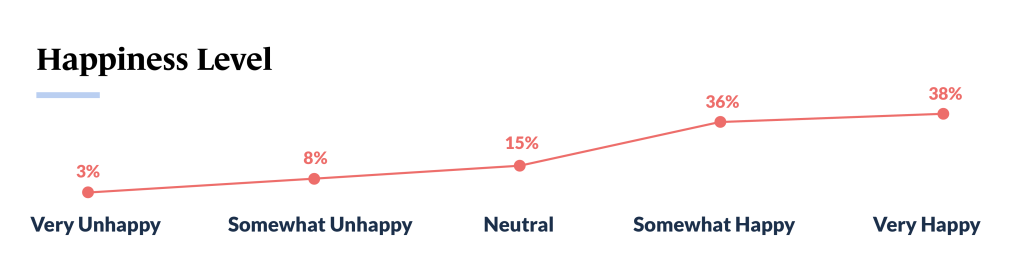

- Regardless of the numerous challenges minority-owned companies face, a big 74 p.c of respondents reported being both “very completely satisfied” (38%) or “considerably completely satisfied” (36%) as small enterprise homeowners. A mere ten p.c of enterprise homeowners felt “very sad” (3%) or “considerably sad” (7%).

- The variety of very completely satisfied enterprise homeowners of coloration rose by 33 p.c in comparison with the earlier 12 months, displaying a optimistic development in total happiness.

The 2023 Small Enterprise Tendencies Research has painted an encouraging image of entrepreneurs of coloration who, regardless of dealing with vital hurdles, proceed to drive development, show resilience, and categorical optimism of their enterprise journeys. Because the age divide narrows, we will anticipate an more and more various and younger set of enterprise homeowners making their mark on the small enterprise panorama.

Guidant’s Entrepreneurs of Coloration report reveals that minority-owned small companies are predominantly worthwhile, even with many being new companies. Most respondents surveyed additionally categorical happiness as enterprise homeowners — with extra enterprise homeowners of coloration reporting satisfaction in comparison with our total research. Though many respondents really feel optimistic and content material, they’ve braved their justifiable share of challenges this 12 months.

Recruitment and retention, inflation, and lack of capital had been among the many high challenges for enterprise homeowners of coloration this 12 months. Regardless of these persistent challenges, nevertheless, small enterprise homeowners of coloration proceed to make vital strides, particularly in recruiting — outpacing all different small companies within the nation.

At Guidant, we’re dedicated to selling development and success in underserved communities, with a particular concentrate on supporting companies owned by girls and entrepreneurs of coloration. We’re thrilled to assist assist and improve range within the small enterprise world. Since 2003, Guidant has offered help to over 30,000 small companies throughout America, empowering quite a few entrepreneurs.

Our workforce of economic consultants can work with you to create a customized financing technique tailor-made to what you are promoting objectives. Plus, we provide cost-effective Accounting & Tax and Payroll providers to deal with all of your wants, permitting you to attenuate administrative duties and concentrate on rising what you are promoting. Contact our workforce right this moment at 425-289-3200 to find how Guidant might help assist and switch what you are promoting desires into actuality!

[ad_2]