[ad_1]

Do you’ve gotten a retirement plan? Chances are high, you do. Retirement account house owners usually have both a 401(ok) from a present employer or an Particular person Retirement Account (IRA). However do you know that you should utilize your IRA to begin a enterprise — or develop your present enterprise?

That is referred to as 401(ok) enterprise financing — and it’s been rising in reputation amongst aspiring and present small enterprise house owners. Primarily, 401(ok) enterprise financing permits you to use cash out of your retirement plan to begin a enterprise or entry extra capital to your present enterprise! And you’ll continue to grow your retirement funds as what you are promoting grows.

Whether or not you’ve gotten a 401(ok) or an IRA, you need to know the way your retirement funding technique can contribute to your monetary success. You must also know what number of {dollars} you’ve gotten in retirement plans and the way you should utilize them to your benefit.

However how have you learnt in case you qualify for 401(ok) enterprise financing or if it’s one of the best enterprise resolution for you? Preserve studying to search out out. In terms of enterprise funding, the extra you already know up-front, the higher!

What Are IRAs?

An Particular person Retirement Account (IRA) could be a good method to save and develop your monetary belongings. Why? You will get favorable tax preparations if you put funds in an IRA.

Actually, in case you ask a monetary planner, you’ll possible hear that IRAs are one of many extra versatile retirement-saving strategies out there to most individuals. Nonetheless, there’s plenty of misinformation about what you are able to do with the money in your IRA, even amongst licensed monetary advisors.

Most know that you simply’ll face withdrawal and tax-penalty charges in case you withdraw funds out of your retirement early. However do you know that you should utilize your retirement belongings — with tax-free withdrawals — to fund a enterprise?

If you wish to fund what you are promoting debt-free and cash-rich, you should utilize your IRA for enterprise financing.

Can You Use Your IRA to Begin a Enterprise With a Mortgage?

Not technically. You’re not taking out a mortgage if you use your IRA to begin a enterprise or fund what you are promoting. As a substitute, you’re utilizing the retirement {dollars} you have already got in your IRA account as an funding right into a privately held enterprise. And it’s attainable to take action with out worrying a couple of taxable occasion or early withdrawal penalty charges.

All you want to know is the IRA transaction guidelines — and discover the correct financing technique for you.

Enterprise Financing with Rollovers for Enterprise Startups (ROBS)

Probably the most well-liked enterprise financing strategies is 401(ok) enterprise financing, also called Rollovers for Enterprise Startups (ROBS). ROBS permits you to merely roll over funds out of your retirement plan into what you are promoting. In a nutshell, to make use of ROBS, you’ll must register what you are promoting as a C Company enterprise entity and create a 401(ok) plan for what you are promoting. With ROBS, you possibly can transfer cash out of your present retirement plan into your new 401(ok) plan, which may then be used to fund what you are promoting debt-free. Bear in mind: ROBS isn’t a mortgage! ROBS permits you to finance what you are promoting with cash out of your IRA or 401(ok) plan. And also you don’t have to fret about debt, tax penalties, or withdrawal charges.

Borrow IRA Funds with 60-Day Rollovers

One other method to faucet into your retirement funds is utilizing the 60-day distribution rule. The Inner Income Service (IRS) usually refers to this as 60-day rollovers. Because the rule’s title suggests, the IRS offers you 60 days from the date you obtain an IRA or retirement plan distribution to roll it over to a different plan or IRA. Whilst you can’t take funds instantly out of your IRA (like you possibly can with ROBS), you should utilize the 60-day rollover to quickly borrow cash out of your IRA. However utilizing the 60-day rollover does include dangers.

Self-Directed IRAs

It’s also possible to make investments extra distinctive belongings in your retirement financial savings by way of a self-directed IRA. A self-directed IRA is a kind of particular person retirement account. It permits you to save for retirement with unconventional belongings like actual property or cryptocurrencies. Nevertheless, a self-directed IRA might be complicated, tough to handle and incur extra charges. Some traders use the tax benefits of an IRA to diversify their investments and use non-traditional belongings as investments.

Mortgage Variations Between an IRA and 401(ok) Plan

There’s usually confusion between IRAs and 401(ok) plans as a result of most 401(ok) plans help you borrow out of your account by way of “participant loans.” In different phrases, you should utilize the cash out of your 401(ok) for any objective — however you possibly can solely borrow as much as $50,000, which is the lesser of fifty % of the entire quantity of funds in your 401(ok) plan, or $50,000. There may also be a comparatively quick reimbursement time period. IRAs don’t permit participant loans, in contrast to 401(ok)s and different plans corresponding to 403(b)s, 457 plans, different kinds of profit-sharing plans, or as an outlined good thing about a pension.

In brief, you possibly can’t take a mortgage out of your IRA for any motive, together with beginning a enterprise. The closest factor to taking a mortgage out of your IRA is utilizing a 60-day-rollover, which helps you to borrow cash out of your IRA plan for 60 days. (See our above part “Borrow IRA Funds with 60-Day Rollovers” for extra info.)

However you possibly can nonetheless use the cash in your IRA — with out penalty or debt — to begin a enterprise or fund what you are promoting ventures by way of various kinds of transactions, like Rollovers for Enterprise Startups (ROBS).

Can You Mix Retirement Plans for Enterprise Financing?

Reply: No, you possibly can’t mix retirement accounts with spouses or companions. However you possibly can title a beneficiary of your account. Your partner or companion can solely roll over their retirement funds in the event that they’re additionally concerned within the enterprise.

Do You Should Stop Your Job to Use 401(ok) Enterprise Financing?

Reply: Not essentially! You’ll be able to preserve your job and use 401(ok) enterprise financing by utilizing an in-service rollover. An in-service rollover permits you to entry retirement funds out of your present employer’s plan into what you are promoting’s 401(ok) plan — whereas retaining your present employment.

It’s also possible to increase an in-service rollover with Rollovers for Enterprise Startups (ROBS) to entry funds from different retirement accounts.

Have extra questions on how Rollovers for Enterprise Startups (ROBS) works? See our full ROBS FAQ!

Can Your IRA Spend money on Your Enterprise?

Investing your IRA funds can get complicated. Let’s break down some generally used phrases in IRA enterprise funding, beginning with prohibited transactions.

What’s a Prohibited Transaction?

The quick reply? It’s a nasty thought. The longer reply? A prohibited transaction is the improper use of IRA funds by the proprietor, which suggests you or the beneficiary of the plan, not the corporate or monetary establishment that holds the IRA.

The IRA belongings are handled as in the event that they have been distributed on the primary day of the 12 months if a prohibited transaction happens. However prohibited transactions include penalties, like a taxable occasion, a further tax on the quantity concerned, and early withdrawal charges (in case you’re underneath the age of 59 ½). You need to keep away from these eventualities! Let’s take a look at some examples of improper makes use of of IRA funds, which may price you.

Examples of Improper Makes use of of IRA Funds:

- Taking a mortgage from the IRA. IRAs are prohibited from making loans to any occasion.

- Utilizing IRA funds for an actual property buy (together with a rental house or different rental properties).

- Utilizing IRA funds as collateral to safe a mortgage.

- Paying an excessive amount of for IRA plan administration.

Improper Makes use of of IRA Funds with Household Members:

- A sale, change, or property leasing between the IRA plan and a associated member of the family.

- Lending cash out of your IRA plan to a associated member of the family.

- Furnishing items, companies, or amenities utilizing your IRA funds to a associated member of the family.

- Switch to, or use by, a associated member of the family of the revenue or belongings of the IRA plan.

- Act by a associated member of the family whereby they take care of the revenue or belongings of the IRA plan in their very own curiosity or for their very own account(s).

- Receipt of any profit for their very own private account by any associated household occasion in reference to a transaction involving the revenue or belongings of the IRS plan.

What’s a Self-Directed IRA?

Are you a present or potential enterprise proprietor wanting to make use of your IRA to fund a enterprise? In that case, you’ll must know some key IRA guidelines. We briefly touched on self-directed IRAs earlier. In a nutshell, self-directed IRAs are passive funding autos used to speculate funds in a enterprise — however usually, not your individual non-public enterprise.

Observe which you could’t use cash out of your IRA as collateral or as a down fee on a mortgage until it’s a non-recourse mortgage. Meaning no private assure is required. Moreover, all these loans are solely out there by way of some non-public lenders who cost a wholesome premium. And it’s difficult to discover a non-public lender who will concern non-recourse loans. You’ll additionally need to be cautious of predatory lending points as a result of these loans have much less regulation!

In case you use a self-directed IRA to spend money on a enterprise, understand that you possibly can’t be concerned in working the enterprise. Why? In case you’re utilizing cash out of your self-directed IRA to spend money on a enterprise you’re concerned in, it’s thought-about a prohibited transaction.

Self-directed IRAs additionally don’t allow you to draw a wage from the enterprise. You’ll solely be capable of possess as much as 50 % particular person or private possession within the enterprise.

How To Use Your IRA to Begin a Enterprise or Get Enterprise Financing

Utilizing an IRA to purchase or fund a enterprise isn’t prohibited so long as you utilize the correct car for that cash. Rollovers as Enterprise Startups (ROBS) is a powerful financing possibility if you wish to use your IRA to:

- Begin a small enterprise from scratch and purchase enterprise property.

- Purchase an energetic enterprise or grow to be a franchise proprietor.

- Make investments extra into and increase your present enterprise.

Bear in mind: ROBS isn’t a mortgage or a self-directed IRA. With ROBS, you possibly can entry your cash out of your IRA penalty-free. It’s additionally essential to notice that ROBS isn’t a tax loophole; ROBS is a authorized method to fund a enterprise along with your retirement funds. However how does ROBS work?

Let’s break down the essential steps to fund what you are promoting along with your retirement cash utilizing ROBS. See in case your retirement plan qualifies for ROBS right here.

How one can Setup Rollovers for Enterprise Startups (ROBS)

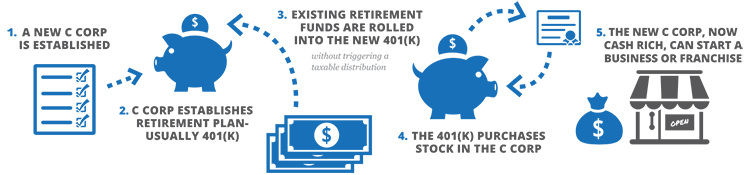

First, you want to set up a C Company (C Corp). That C Corp then establishes a retirement plan, often a 401(ok). Subsequent, you possibly can roll your present retirement funds in your IRA or 401(ok) into your new 401(ok) to your C Corp.

Your C Corp’s 401(ok) plan may now act as your angel investor and buy inventory. The brand new C Corp can begin a enterprise or fund a franchise from there!

As soon as the ROBS course of is full and the enterprise is funded, the cash can be utilized for nearly any enterprise objective. Not like typical IRA investing or self-directed IRAs, the cash from ROBS funding can be utilized to:

- Fund a start-up enterprise from the bottom up. With ROBS, you possibly can simply use your IRA to begin a enterprise.

- Buy an present enterprise or franchise.

- Put a down fee on a small enterprise mortgage.

- Increase an present enterprise.

- Purchase gear, provides, or rental property for what you are promoting.

ROBS funding permits new and seasoned small enterprise house owners to make use of their private funds in an IRA to fund a enterprise — with out having to fret about prohibited transactions or mortgage funds.

And since you’re not working inside the guidelines and laws of self-directed IRAs, you possibly can launch a completely working enterprise as an proprietor who can draw a wage. So, you’re in full management of your retirement funds and your pay — with out taking a taxable distribution. That’s why ROBS is changing into an more and more well-liked approach to make use of your IRA to begin a enterprise.

Need to know the ins and outs of 401(ok) enterprise financing? Take a look at our Full Information on Rollovers for Enterprise Startups (ROBS).

Tailor-made Funding Choices For You

In case you’re prepared to make use of your IRA to begin a enterprise or develop your present enterprise, Guidant Monetary may help you get began! We’ll stroll you thru the ROBS course of and enable you to get the cash you want stress-free, whether or not you’re a present or potential enterprise proprietor.

Contact us for a FREE session at 888-472-4455 or pre-qualify now for 401(ok) enterprise financing:

[ad_2]