[ad_1]

Financing your dream small enterprise or franchise is feasible with 401(okay) enterprise financing, often known as Rollovers as Enterprise Startups or ROBS. The corporate that may assist you by means of the mortgage course of and past? As America’s #1 ROBS supplier and a trusted chief in small enterprise financing, Guidant Monetary can assist you all through your funding journey with ROBS.

While you’re searching for an organization to companion with in making your goals of small enterprise possession a actuality, doing all your homework is vital. Turning into a enterprise proprietor is likely one of the most fun and difficult selections you’ll make — and also you’ll wish to have a powerful help system behind you, and know all of the information earlier than you soar in with each ft.

As you do your analysis on corporations and financing choices, you would possibly ask your self: What’s Rollovers as Enterprise Startups (ROBS)? Is this kind of 401(okay) enterprise financing authorized? What does Guidant Monetary, or a ROBS supplier, even do? Are ROBS suppliers scams or authentic corporations? These are precisely the questions we’ll reply right here. Preserve studying for extra details about Guidant — and most significantly, how we can assist you employ your retirement funds to safe your small enterprise or franchise.

Let’s begin with probably the most generally requested questions amongst entrepreneurs contemplating ROBS…

Prepared to start out your online business dream? Listed below are the 10 Steps to Beginning a Enterprise.

Is that this “Rollovers for Enterprise Startups (ROBS)” factor authentic? The quick reply is: Sure. In reality, ROBS or 401(okay) enterprise financing is a brilliant and authorized means to make use of your retirement funds to fund your small enterprise or franchise. To achieve a greater understanding of what ROBS is, let’s talk about the way it works.

Additionally referred to as 401(okay) enterprise financing, ROBS is a technique of funding the place you employ cash from an eligible retirement account to purchase a small enterprise or franchise with out incurring tax penalties or getting a mortgage. The ROBS program was made attainable by the Worker Earnings Safety Act of 1974 (ERISA), which handed the accountability of retirement saving from the employer to the worker. In easy phrases, you’ve the correct to make use of your retirement funds as you see match — together with for a small enterprise.

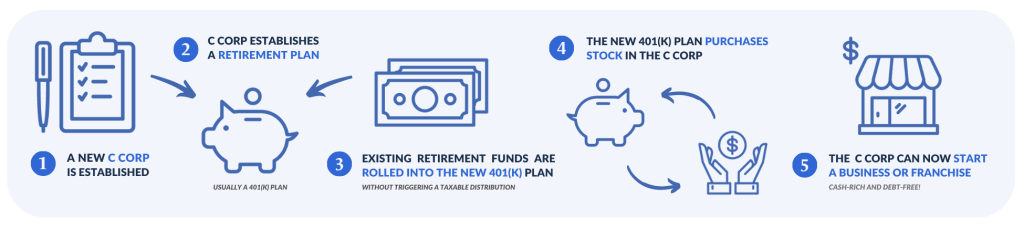

That stated, the ROBS construction should be shaped appropriately to qualify beneath IRS code and entails 5 steps. Though advanced, these steps can often be accomplished in about three weeks. We’ll break them down for you right here:

How ROBS Works in 5 Steps:

- A brand new enterprise is established as a C Company (C Corp). (Extra on why that is so essential later.)

- That company creates a brand new 401(okay) plan that may buy non-public inventory.

- Funds from the present retirement account are rolled into the brand new 401(okay) plan — with out triggering a taxable distribution.

- The 401(okay) plan purchases inventory within the C Corp.

- The C Corp acquires or begins a enterprise utilizing these funds.

A C Company is a enterprise entity — and to make use of ROBS, it is advisable to register your online business as one. However what’s a “C Corp” and its potential downsides or upsides? Discover out right here.

Watch this four-minute video that breaks down how 401(okay) enterprise financing — often known as Rollovers for Enterprise Startups (ROBS) — works from a ROBS Guidant Professional, Katie Burckhardt. On this video, Katie will overview:

- What’s ROBS?

- How does ROBS work?

- What retirement plans are certified for ROBS?

- How can I fund my enterprise with ROBS?

For a full breakdown on what ROBS is — and the way the ROBS construction can work in favor of your online business, see extra in What’s ROBS? How 401(okay) Enterprise Financing Works.

Let’s talk about the advantages of the tax-free association that’s helped hundreds of entrepreneurs purchase companies they in any other case may not have been capable of afford. Some entrepreneurs even discover 401(okay) financing has given them a leg up over competitors as they’ve much less (if any) debt to repay. Be taught All the things You Have to Know About ROBS in our newest FREE webinar.

Advantages of ROBS

- Management over your funding efficiency. Not like investing within the inventory market, utilizing ROBS means that you can immediately affect the efficiency of your online business.

- Faster path to profitability. As a result of ROBS isn’t a mortgage, there aren’t any rates of interest concerned, and no repayments to be made. No matter income your online business brings in will be reinvested again into the enterprise.

- No credit score rating necessities. When you’ve got at the very least $50,000 in a rollable retirement account, you’re eligible to make use of the ROBS methodology. There aren’t any credit score or collateral necessities.

- Funds can be utilized as a mortgage down fee. If you happen to nonetheless want a small enterprise mortgage, the rolled funds from ROBS can be utilized because the down fee, permitting you to maintain your private financial savings intact.

Take a better have a look at the Professionals and Cons of ROBS (Rollovers for Enterprise Startups).

Whereas the ROBS construction doesn’t have many qualification necessities, you’ll want to stick to strict tips within the formation and upkeep of ROBS plans. These embrace:

- The enterprise entity should be a C company. You’ll see this talked about every time ROBS is mentioned. That’s as a result of the ROBS association is hinged on the sale of Certified Employer Securities (QES). This implies the enterprise you begin or purchase should function as a C company, which may promote inventory. If you wish to know extra about C companies, you possibly can study extra in our Full Information to ROBS.

- A brand new retirement plan that permits for the acquisition of personal inventory should be created for the company (often a 401(okay) plan). You get to decide on the plan kind, however most Guidant purchasers choose a regular 401(okay) plan. Different choices embrace outlined advantages, outlined contributions, revenue sharing or a mix of plans. As soon as a plan kind is chosen, you’ll want to pick out a custodian to handle the precise investments within the plan.

- The enterprise proprietor should function a fiduciary for the retirement plan. This implies, because the enterprise proprietor, it’s essential to all the time do what’s in one of the best curiosity of the plan.

- The retirement plan should file an annual report (IRS Kind 5500). A 3rd-party administration agency handles the plan administration and can put together the mandatory annual reporting and file your annual Kind 5500.

- All advantages, rights and options of the retirement plan should be made successfully obtainable to staff. All collaborating staff should be handled equally, so that you’ll must handle the plan to make sure you adjust to this requirement.

- The plan should hold an correct recordkeeping system to trace and decide plan participation, contributions, incomes and losses, and so on. Don’t overlook your company taxes are totally different than your obligation to file the aforementioned Kind 5500 annually.

As a result of these necessities will be daunting, you could wish to work with a certified ROBS supplier who can make sure you meet all these situations and supply help within the ongoing upkeep of the plan. That is the place Guidant Monetary is available in.

Is your retirement plan eligible for ROBS? The excellent news is most retirement plans are! See 10 Forms of Eligible Retirement Plans for 401(okay) Enterprise Financing.

Since 2003, Guidant Monetary has made a reputation for itself as an business chief in small enterprise financing, particularly for ROBS. Our workforce has helped greater than 30,000 enterprise house owners all 50 states make investments greater than $5 billion in retirement property into small companies and franchises. These companies immediately make use of over 80,000 People. Be taught extra about Guidant right here.

Whereas our former headquarters had been positioned in Bellevue, Washington and Boise, Idaho, Guidant is now a totally distant firm with about 240 devoted professionals who’re obsessed with serving entrepreneurs. This contains the next:

- Monetary Consultants. This workforce is devoted to serving to you establish whether or not ROBS is best for you. They’ll present instruments and assets to teach you on ROBS, and even assist you select the correct enterprise to purchase.

- ROBS Onboarding Group. This division focuses on serving to you arrange your new C Company and retirement plan, so you possibly can rollover your retirement funds tax penalty-free.

- 401(okay) Plan Administration. As soon as your company is funded, our Plan Administration workforce helps preserve your 401(okay) plan and put together your IRS Kind 5500.

- Authorized. Guidant’s in-house compliance workforce evaluations your annual Kind 5500 to make sure your plan stays in good standing.

Extra on Guidant’s Administration Companies and Authorized Illustration

After you’ve arrange your new company and 401(okay) plan, you possibly can turn out to be a Guidant administration shopper for an reasonably priced flat month-to-month price. Guidant can do your record-keeping and put together your annual Kind 5500, full required and elective plan amendments, and supply a devoted help workforce and authorized counsel.

We additionally companion with skilled tax attorneys who help you within the setup and ongoing upkeep of your 401(okay) plan as part of your record-keeping companies. We refer to those attorneys as your “Outdoors Counsel” as a result of they don’t work for Guidant — they signify you and your greatest pursuits. That is one other means that Guidant helps defend you and your distinctive monetary targets in terms of the world of small enterprise.

As part of our strong authorized companies, we additionally present full audit safety. In case your 401(okay) plan is ever audited, each our in-house employees and specialised Outdoors Counsel will work with you thru the audit as part of your record-keeping companies — doubtlessly saving you hundreds of {dollars} in authorized illustration. No Guidant shopper has ever paid tax penalties because of the ROBS construction.

Don’t Simply Take Our Phrase for It

Understandably, it may be robust placing your belief in an organization that’s tons of and even hundreds of miles away from the place you propose to construct your new enterprise. Of the numerous monetary suppliers obtainable to you, we imagine we’re one of the best candidate for the job — however hold studying to study why. Many business and civic organizations have helped validate our work:

- We’re rated A+ by the Higher Enterprise Bureau.

- Ranked within the High 3 Financing Options in Entrepreneur Journal’s Franchisor’s Provider’s Awards for the final six years.

- Nominated as a finalist for the 2023 Higher Enterprise Bureau (BBB) Torch Award in Ethic’s.

- We’re one of many Inc. 5000 – the quickest rising corporations within the nation.

- Our founders are acknowledged leaders and champions of entrepreneurship.

- We’ve a trophy case of honors and awards.

- We preserve a degree of excessive satisfaction on Reseller Rankings.

You may also hear what a few of our present purchasers must say about us and their thriving small companies and franchises:

Uncover extra Guidant shopper success tales right here.

In search of inspiration? See our 5 Should-Know Guidant Enterprise Proprietor Success Tales.

Extra Enterprise Financing Choices with Guidant

As beforehand talked about, one of many advantages of ROBS is that it may be used together with different types of enterprise financing. Guidant affords a full suite of financing choices that can be utilized alone or together with ROBS that can assist you meet your whole funding wants:

Enterprise Valuation Options

Along with enterprise financing choices, Guidant affords enterprise valuation options to convey transparency to the usually tough and time-consuming means of understanding the worth of a enterprise. If you happen to’re undecided the place to start out wanting once you’re attempting to worth, purchase, or promote a enterprise, you’re not alone. However now you’ve the next assets to assist worth a enterprise sooner and with much less problem:

Enterprise Companies

At Guidant, we’re within the enterprise of serving to small companies succeed. That’s why we over a bunch of enterprise companies — tailor-made for small enterprise house owners to thrive and keep in price range. The perfect half? You’ll work with an actual workforce of monetary specialists who’re devoted to serving to you meet your online business targets. Guidant can help you all through the lifetime of your online business with:

We hope this helps you get to know Guidant a bit higher and ease your thoughts about our firm and our 401(okay) financing providing. If somebody asks, “Is 401(okay) financing authorized?” or “Is Guidant authentic?”, you’ll now be capable of reply “sure” — shortly and confidently. As you proceed to analysis small enterprise financing companions, we propose reviewing these assets as a subsequent step:

Keep in mind: Our workforce is all the time completely satisfied to speak with you about turning your dream enterprise into your actuality — with no matter type of financing works greatest for you.

Name us right now at 425-289-3200 for a free, no-pressure enterprise session to get began — or pre-qualify in minutes for enterprise financing now!

“I owe a way of gratitude to Guidant for serving to me get right here. It was a turning level for us transferring ahead.”

— Stephen Such, Falling Sky Brewing

Learn the tales of REAL small enterprise house owners who work with Guidant.

[ad_2]